Crypto is a Bullshit Industry. Yes, all of it you nerd

the stupidest industry is also, somehow, the most evil

Hi, I’m an existential imbecile named Max Murphy. Here on The Murphy Memos we explore the absurdity of existence.

Consider subscribing if you’re into that kinda thing.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” —Upton Sinclair, Candidate for Governor: And How I Got Licked

It started with a Twitter Ratio.

Kenneth, an econ prof admits he misread crypto, thinking that it would be sensibly regulated.1

An investor claps back with the pErMisSiOnLesS pAyMeNtSs line—to the vindicating screech of crypto twitter, that landfill of garbage cartoon avatar2 NFT pfps.

But here’s my question for Lyn: when was the last time you used crypto to pay for something? Anything?

Probably never.

Because nobody does.

They harp on these noble talking points bc it sounds much better than “yeah, I’m just getting rich by dumping my bags on know-nothing retail investors.”

The crypto fantasy is beautiful, borderline utopian.

The crypto reality is a dystopian ponzi scheme.

I knew a guy who worked a gas station.

We were both interested in crypto.

One day, he found the coin.

It was JasmyCoin.

He went all in.

He pulled out his phone to show me his portfolio. I could not believe the amount.

Over $800,000 fucking dollars of JasmyCoin.

“Oh fuck.”3

This was his entire family’s life savings he’d invested — confident it would double, no triple, in just a few days.

…

Do I even need to tell you how it ended?

After, he wasn’t at the gas station anymore.

Stories like this happen on a daily basis in crypto.

They’re common, banal, perhaps the default experience.

Euphoric enthusiasm followed by heartbreaking disappointment.

I entered the industry as a doe-eyed idealist, excited to disrupt the broken financial system and make the world a better place. But what you say and what you do aren’t always the same.

“Gotta break a few eggs to make an omelette” is what insiders tell themselves about people like my gas station friend.

But after seeing how the sausage is made…

I realized we aren’t making the world a better place.

We’re cooking a breakfast laced with financial ruin.

From top to bottom, this industry is rancid, rotten to the core.

Crypto is what happens when a tech bro fucks a casino and botches the abortion.

Grift or Die

The list of things Crypto Bros get right begins and ends with exactly 1 thing: the existing financial system is fucked.

Now, I could list out all the problems with the economy today.

But you already know.

From experience.

Don’t you?

But if you really want the numbers, just go read some kyla scanlon if you need someone who actually knows wtf they’re talking about.

You graduate college, pile up five or six figures of debt, and land a job that pays less than your parents made without a degree. You’re told to “just work hard” in a labor market where every rung of the ladder is greased with outsourcing, automation, and bullshit.

I know PhDs in neuroscience, literature, anthropology, sociology—people who’ve devoted a decade or more of their lives to mastering a discipline, a real discipline—only to wind up working in crypto because it’s the only damn thing that pays.

That’s the quiet part nobody wants to say out loud: crypto looks like an opportunity because everything else is a dead end.

Crypto dresses itself up in utopian rhetoric.

Anti-establishment: Stick it to the banks.

Decentralization: Power back to the people.

Financial freedom: Anyone can join (and profit).

If you’re young, ambitious, and broke, that sounds intoxicating.

But sooner or later… you figure out where the money comes from.

Crypto is the actualization of Jordan Peele’s 2019 masterpiece, Us.

The Tethered Economy

In the film, the comfortable lives of middle-class families are “tethered” to uncanny Doppelgängers who live in a liminal underground hellscape where they’re forced to eat raw rabbit.

Every moment of leisure, every beach trip, every smile is paid for with the unseen suffering of someone else.

That’s crypto in a nutshell.

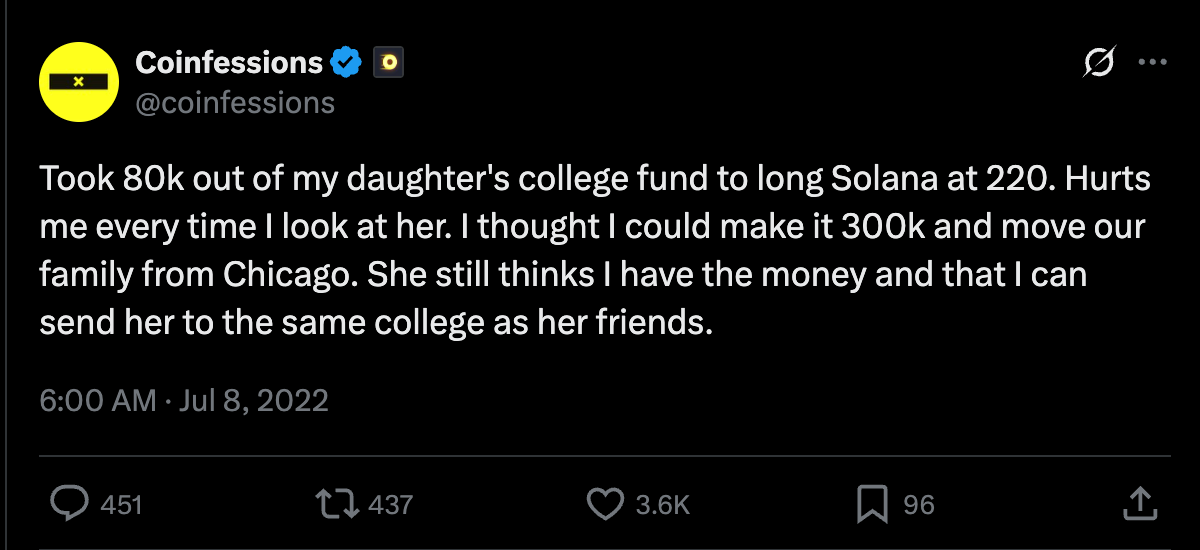

The only difference is that in crypto, the tethered aren’t rising up for revenge (yet), they’re turning to anonymous confession accounts like Coinfessions where they share the dark truth about what crypto has done to them, their finances, and their families.

These stories are disgustingly common across crypto.

A few recent highlights include…

Someone who dropped out of college to dedicate their life to trading crypto

Another child losing tuition money while a crypto founder parties in a $30k/night hotel

Someone making $400k, and losing it all: “My life is fucked man, I’m dead inside”

One of the few who profits admits to lying and deceiving others

If you want an idea of how bad things really are, check out Molly White’s web3 is going great.

The reason Lyn, and people like her, keep hyping up crypto’s “legitimacy” is because the more people that become tethered, the more money the Crypto Bros make.

Doesn’t matter if there are daily hacks, scams and exploits.4

Doesn’t matter if people actually use any of this shit.

Doesn’t matter if it can’t work, even theoretically.

These clowns pretend like they’re reinventing

innovation itself while recreating a

century-old scam.

Why the SEC Exists

The tech industry’s playbook is always the same: break the law with a new piece of tech, call it disruption, and use your ill-gotten gains to lobby Congress so the grift can continue forever.

Like when they bypassed labor laws with gig work.

Like when the bypassed copyright laws with AI plagiarism.

Like when they bypassed zoning laws with short-term rentals while driving up rent.

Crypto is no different.

In the 1920s, grifters realized you don’t need to actually build a business when you can build a convincing illusion of a business, and profit by selling stocks to suckers.

“One infamous 1920s scam was the Radio Pool, in which manipulators drove up the price of RCA stock, took their profits, and left other shareholders to watch helplessly as their shares sank. To make matters worse, many small investors were enticed into buying shares of companies on margin—essentially, with loans that they had to repay out of their pockets if the stock price went down.” (Source).

Radio Pool did not build infrastructure, or supply chains, or employ a workforce.

It was held together by imagination.

The business was fake.

The money was real.

Sound familiar?

The proliferation of ponzi-schemes contributed to The Great Depression. They called them blue sky stocks: when a stock’s price is completely detached from its actual value.

They’re doing exactly what they did in the 1920s… but with crypto tokens this time.

Instead of blue sky stocks, we have meme coins:5

Fartcoin at ~$800 Million

Shiba Inu at ~$7.5 Billion

Dogecoin at ~$35 Billion

If it sounds absurd… that’s because it is.

These coins don’t do anything. They’re memes. Fucking memes.

Even the ones that pretend not to be memes are just fucking memes.

It’s not new. It’s not clever. It’s not innovation. It’s the same con, rebooted with blockchain. And we already learned the hard way what happens when you let it run unchecked.

That’s why the SEC exists—so we don’t crash the entire fucking economy by investing in smoke and mirrors.. again.

Crypto is David Graeber’s bullshit jobs at the scale of a ~$4 Trillion industry: astroturfing for insiders, financial ruin for outsiders, and an economy that funnels its wealth directly to the worst people on the planet.

Crypto Funds Fascism

The Trump family has turned crypto into its own personal Radio Pool:

Melania Coin/NFTs: ~$200,000

Trump NFTs: ~$22 Million.

Trump Token: ~$350 Million

World Liberty Financial: ~$500 Million

And all of that is just liquid cash. In unrealized gains, they’re sitting on billions.

People like my gas station friend invested in this shit, while the Trump family cashed out.

Billions of dollars vanished into thin air faster than Trump‘s name in the Epstein files.

These are not outliers. These are not a few bad apples. All the apples are bad apples.

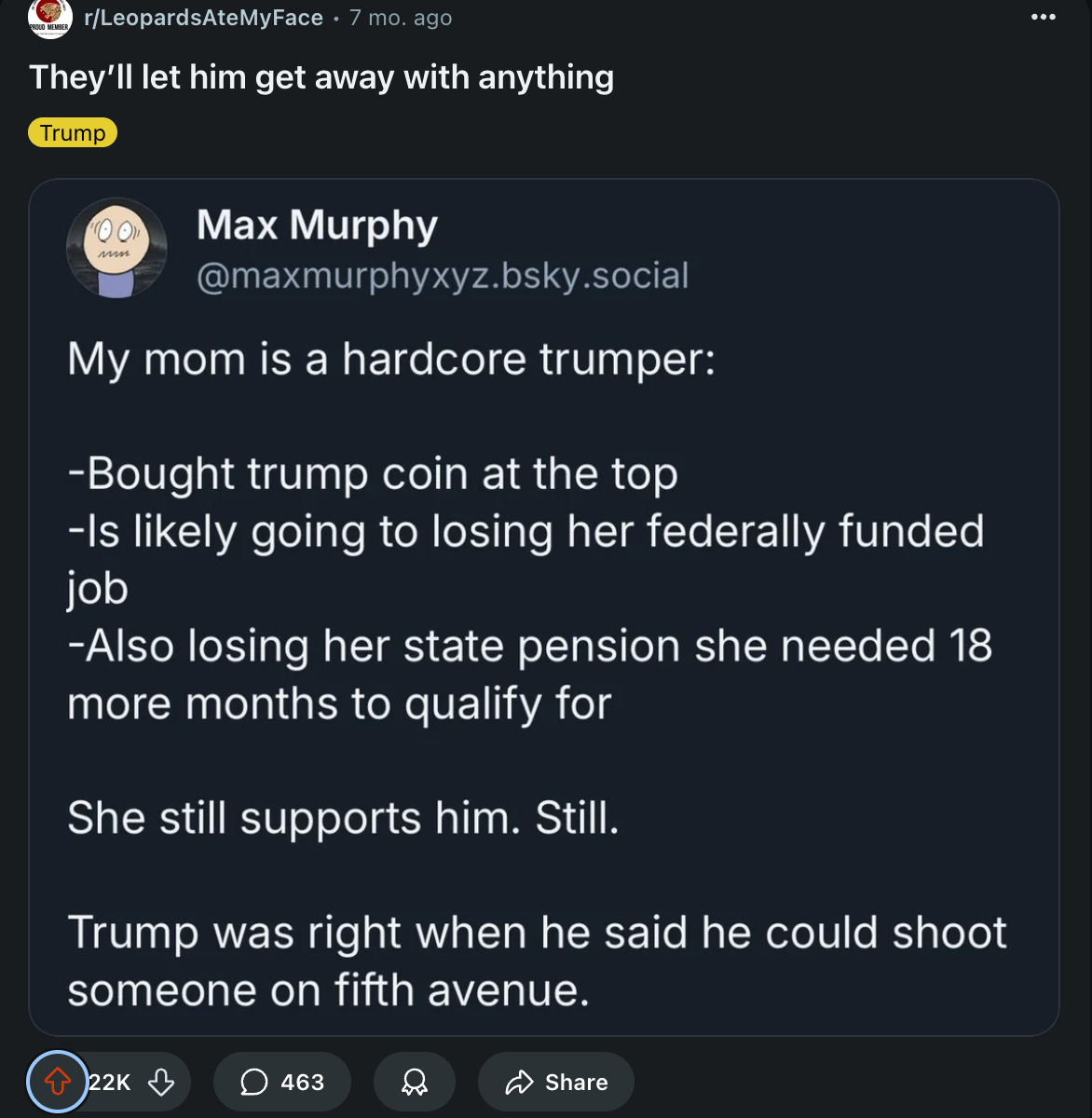

And I know this isn’t just theoretical, because I watched it play out when my own Trump-supporting family members bought Trump Coin at the top…

because Trump told them to.

I even warned them they’d

lose their money.

After the price crashed, they didn’t even understand how they’d been scammed. The baffling buffoons somehow blamed the Democrats for this one too.

This is why Trump is an evil genius.

Crypto turns political loyalty into liquidity.

Strip-mine your base until there’s nothing left.

Crypto isn’t a scam. It’s worse than a scam. It’s the campaign fund for the authoritarian war chest, built dollar by dollar from the very people it destroys.

They want a tethered economy. They want you miserable, underground, invisible and suffering. They want more people writing to Coinfessions about how they liquidated their 401k to buy Melania Coin right before the price crashed.

Maybe it’s time we stop allowing ourselves to become tethered.

Apparently, he didn’t think America would elect a serial crypto scammer to the WH

Unlike my BIGLY BEAUTIFUL MASTERPIECE AVATAR

I nudged him to be more careful, but he was 100% convinced it would moon

As I was writing this, one of the biggest hacks ever happened, with the CTO of Ledger stating, “refrain from making any on-chain transactions for now.” Whoops.

Market caps are at time of writing, in case that wasn’t obvious